Click. Cover. Care

The digital shift transforming how Zambians secure their lives and livelihoods.

The digital shift transforming how Zambians secure their lives and livelihoods.By Francis Maingaila

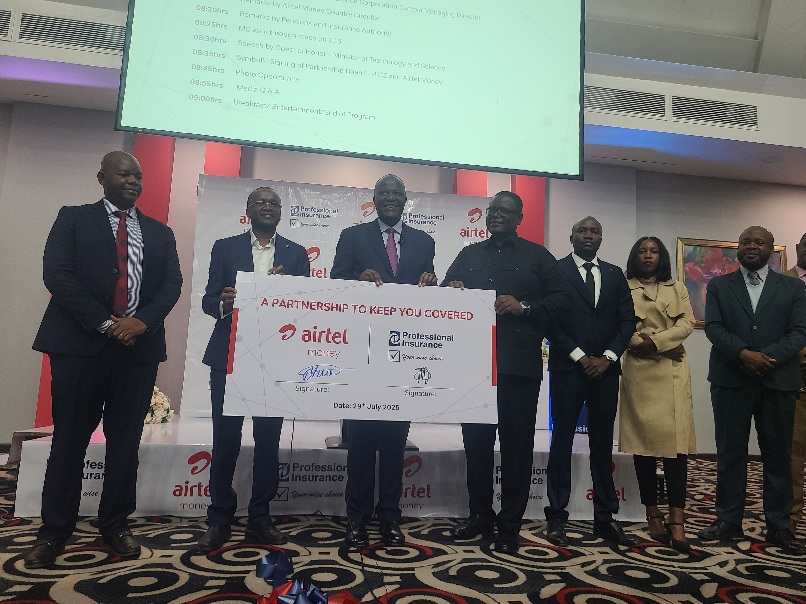

Lusaka, Zambia24 (29 July 2025) - The Pensions and Insurance Authority (PIA), in collaboration with Airtel Zambia and Professional Insurance Corporation Zambia (PICZ), has launched a new mobile-based insurance platform aimed at transforming access to insurance across the country.

The platform, described as a game-changer by both government and private stakeholders, is expected to extend coverage to at least one million Zambians by 2027, particularly those in underserved and rural areas.

Launching the initiative in Lusaka, Minister of Technology and Science Felix Mutati hailed the development as a major turning point in Zambia’s journey toward financial inclusion.

He said that by integrating insurance into mobile money services, the platform would simplify insurance, making it affordable, convenient, and accessible to ordinary citizens regardless of location or income level.

“This is not just a product—it’s a lifestyle change,” Mutati said. “We are putting protection in the hands of ordinary Zambians.”

Mutati expressed concern over Zambia’s low insurance penetration rate, which currently stands at 6 percent, describing it as unacceptable in a country seeking inclusive growth.

He expressed optimism that leveraging Airtel’s network of more than seven million subscribers would help overcome this barrier and significantly improve coverage.

“We have the hands to build. Now we need one mind and one direction to break this barrier,” he stated, emphasizing that the country needs shared vision and collaboration to drive meaningful change.

The minister further underscored the importance of affordability, pointing out that for just K60 per year, citizens can access insurance coverage worth up to K10,000.

“Some people spend more than K60 in a single day. That same amount can secure your life for a whole year,” he said.

Mutati also used the occasion to call on stakeholders to embrace local innovation and invest in homegrown technological solutions, especially those developed by the youth.

“Let’s stop importing solutions. We have the minds and creativity in this country,” he said, urging industry players to recognize the potential of Zambian innovators.

He cited Zambia’s improvement in digital resilience as evidence that the country is ready to lead its own digital transformation.

With a resilience index score of 92.6 percent, one of the highest in Africa, Zambia is now better equipped in terms of cybersecurity and digital infrastructure.

Mutati noted that the mobile insurance platform directly supports the government’s broader goal to expand digital connectivity to 96 percent of the population by 2026, in line with Vision 2030.

Speaking at the same event, Moses Siame, Managing Director of Professional Insurance Corporation Zambia, described the partnership as a groundbreaking approach to insurance delivery in Zambia.

He said the new platform would redefine how Zambians experience insurance by eliminating barriers that have long hindered growth in the sector.

“We are rewriting how Zambians experience insurance,” Siame said.

“Insurance is no longer a complicated product reserved for the elite—it’s now simple, accessible, and fits right into your pocket.”

Siame noted that the platform’s design addresses major challenges such as limited awareness, accessibility, and public mistrust.

The solution is built on three foundational pillars: expanding insurance coverage to underserved communities, improving the customer experience through mobile-based services, and driving overall sector growth via digital innovation.

He emphasized that with this platform, insurance is available anywhere there’s a mobile signal, enabling even rural and remote communities to access protection.

“As long as there is network coverage, insurance is available. No one is too far. No one is left behind,” he said.

Siame further explained that insurance uptake in Zambia has historically remained low due to the perception that it is complex, expensive, and only for the privileged.

The new platform aims to challenge that perception by offering affordable, user-friendly products that cater to the everyday needs of ordinary Zambians.

Professional Insurance brings over 30 years of experience to the collaboration. Since its inception in 1992 with just K52,000 in written premiums, the firm closed 2024 with gross written premiums exceeding K2 billion.

Airtel Zambia, on the other hand, contributes a vast mobile subscriber base and expansive digital infrastructure that ensures widespread reach.

Welcoming the partnership, stakeholders applauded the alignment of the project with the government’s financial inclusion agenda and noted its potential to build resilience for low-income households.

“From today, if you can send money, you can secure your future,” said Siame. “Insurance is no longer just a product—it’s a way of life.”

The service is now available to all Airtel Money users across Zambia, allowing customers to purchase and manage their insurance policies directly through their mobile phones using the USSD code *115#. This eliminates the need for smartphones, internet access, or paperwork.

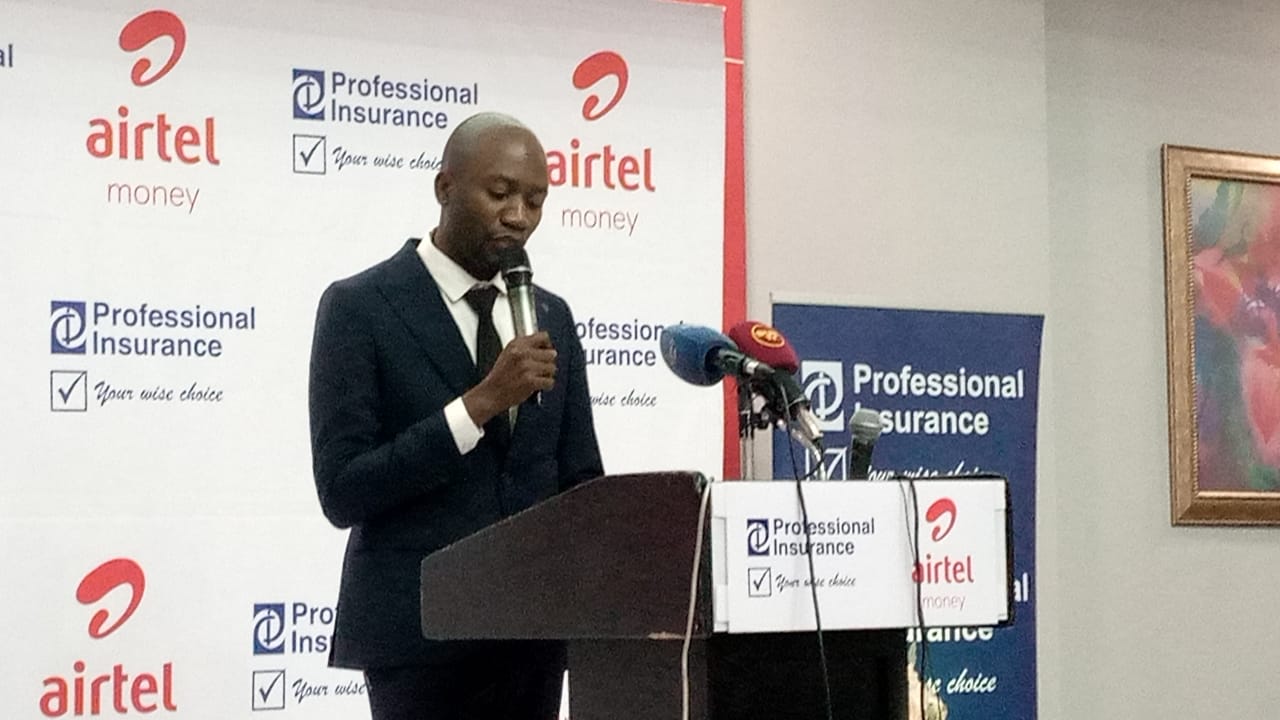

During the launch, Airtel Money Country Director Andrew Chuma described the partnership as a landmark initiative that blends technology with purpose.

He said the platform was developed to empower all Zambians, especially women, youth, and individuals previously excluded from traditional financial systems.

“This initiative is not just about technology—it’s about people,” Chuma said.

“Every aspect of this service is designed with the customer in mind, to ensure that financial solutions are relevant, accessible, and beneficial to daily life.”

Chuma pointed out that the platform offers a seamless user experience, enabling customers to instantly pay insurance premiums, even in emergency situations such as traffic stops, thereby promoting both convenience and compliance.

“This is a safety net for everyone, not just the privileged,” he emphasized. “We’re ensuring that no one is left behind in the digital evolution.”

He added that the initiative also supports national development priorities by helping to integrate thousands of Zambians, particularly informal sector workers, into the formal financial system.

“This collaboration supports government efforts to build a resilient, inclusive financial ecosystem,” he noted. “It is also a major step forward in supporting women and youth to access insurance and other financial services with confidence.”

Chuma urged Airtel Money users to become “ambassadors of change” by promoting the use of the platform within their communities. He also commended Professional Insurance for its leadership and trust in digital finance.

“This is just the beginning,” Chuma concluded. “We’re unlocking life-changing services that are digital, secure, and affordable for all. With Airtel Money, we are not just moving money — we are moving lives forward.”

Also speaking at the launch, Insure Technology Zambia Chief Executive Officer Mwangala Mwiya described the platform as a transformative force for financial inclusion, with the potential to reach millions of people, including those in rural and underserved communities.

“When we started working on this project, we asked ourselves a simple question: How do people buy essential items like electricity, food, and water? The answer was mobile money,” Mwiya said.

“We realised insurance must be just as convenient.”

Mwiya noted that the newly launched service is accessible via USSD code *115# and allows users to buy life, health, and asset insurance with ease. The product does not require internet connectivity or smartphones, making it inclusive by design.

She emphasized that insurance penetration remains low in Zambia primarily due to the complexity of products, affordability issues, and lack of physical access in remote areas.

The platform, she explained, addresses these issues by removing both digital and financial barriers, delivering a secure and user-friendly service.

“This collaboration is not just about business. It’s about impact,” Mwiya said.

“It’s about bringing insurance to every corner of the country and aligning our efforts with Sustainable Development Goal 9, which promotes innovation and infrastructure.”

She commended Airtel for its extensive mobile money network and Professional Insurance for its technical expertise, stressing that the project’s success lies in the strong synergy between all partners.

The platform, she said, was designed to be scalable and inclusive, capable of serving a wide spectrum of users such as small-scale farmers, market traders, and informal workers who previously lacked access to traditional insurance products.

“Our mission is to build a platform that is seamless, scalable, and secure. USSD technology works on every phone, in every village and town,” Mwiya added.

Industry analysts believe this innovation could not only increase insurance uptake in Zambia but also set a model for similar initiatives across Africa.

The event concluded with a collective call to action, urging Zambians to take advantage of the platform to secure their health, lives, and property.

“Let’s celebrate today,” Mwiya said. “But remember—this is only the beginning.”

Comments

Post a Comment